The Benefit That Matters The Most

| June 16, 2009 | Posted by Roshawn Watson under Uncategorized |

Comments off

|

With an economy that has slowed, many new graduates are having trouble finding jobs. Employers plan to hire 22 percent fewer college graduates in 2009. Indeed, some have given up searching for jobs altogether and instead are returning to school (or home) or simply not working for awhile. Although there are some who are fortunate enough to take the time off to volunteer, do civil service work, or pursue other interests while waiting for their dream job, this simply is not feasible for most.

Interestingly, the unemployment of recent college graduates often goes grossly unreported or under-reported. Consider that in last November, “the number of college graduates who were working fell by 282,000, while only 2,000 more college graduates were classified as unemployed” (Alan Krueger, NY Times) The gap existed because of the Bureau of Labor Statistics classification guidelines. To be counted as unemployed by the BLS, one must not only be laid off but also be actively searching for jobs for at least 4 weeks. Due to the stigma of being unemployed, many students have claimed that they are not actively searching for jobs.

Show Me The Benefits

Despite a soft job market, many recent graduates are unrelenting regarding the benefits and expectations they find acceptable. According to a recent study performed by eHealth Insurance, an overwhelming majority of study participants (89%) are sure they’ll find a job related to their major once they finish school. Additionally, 85 percent believe their first job after college will provide them with a health plan.

Other key findings suggest that recent graduates value health insurance but don’t understand terminology related to their plans.

- Over six in ten (61%) college students would rather live with their parents for the first year after they graduate than go without health insurance during this period of time.

- Many would take care of their own coverage instead. More than six in ten (63%) want to find their own health insurance plan and keep it regardless of where they work, not switch health plans with every job.

- Less than one in five (16%) would part with their health insurance if money was tight after finishing school; cell phones (13%) and access to the web (12%) are just as important to hang onto. Other expenses like cable TV (48%) would be much easier to do without (I like cable as much as anyone else, but I would definitely part with it if it was financially unfeasible).

- But less than half of college students can define basic terms such as deductible (41%) or premium (29%).

It is perfectly reasonable for health insurance to be very important, regardless of whether it is is a company benefit. Unfortunately, many neglect to appropriately insure themselves due to limited finances or perhaps some feel that they’re invincible. However, it is a verifiable fact that one of the biggest threats to one’s finances is medical illness. Medical illness is the leading cause of personal bankruptcy. Often, the bankruptcy is not just due to the medical bills but rather the corresponding loss in income associated with the illness. This is a real problem even for recent graduates because they make up the 2nd fastest growing group filing bankruptcies in America.

Even though younger individuals tend to be healthier, going without medical insurance is like playing a game of roulette. For example, I know someone battling inoperable brain cancer who is 28 years old. He got his original diagnosis while still in school. Without insurance, his family would have to struggle to survival financially, which is the last thing you want to worry about in such as situation.

The Missing Benefit

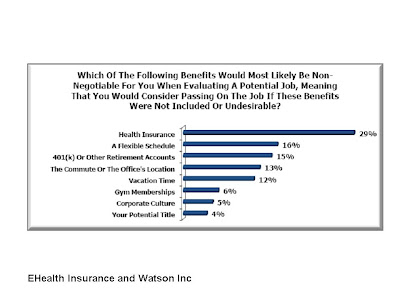

29% of respondents said that health care insurance was a nonnegotiable benefit when evaluating a potential job. Not surprising, but also troubling, is that disability insurance apparently did not rank on the list of non-negotiable benefits but flexible scheduling does (click here for better image resolution). However, financially it is a mistake to go without disability insurance. If one is 30 years old, he or she is statistically 12 times more like to become disabled by age 65 than dying, yet disability insurance remains one of the most under-insured areas in the insurance arena. Perhaps it wasn’t even included in the survey, but make no mistake, long-term disability can be financially devastating, so protecting yourself financially with insurance is the prudent thing to do. Apparently, we somewhat got the message of health-care insurance importance, but there’s work to be done on the disability insurance front.

Lastly, hopefully the graduates will use common sense when selecting their jobs. If they have job offers but are sitting on their bottoms because these jobs don’t offer the optimal insurance packages, then perhaps they have unrealistic expectations given their levels of experience and expertise. In some cases, they may have to furnish the insurance themselves or deal without some of the extra coverages. In short, although it may not be too smart to deliberately go without medical or disability insurance, in most cases it makes even less financial sense to go without a job because you can’t get the insurance package you desire.

Lastly, if you like this post, please subscribe (upper right-hand corner); you will my free ebook; also, support this post and Propel it, Stumble it, and tag it on Delicious.

Related Posts

Copyright 2012, Roshawn Watson, Pharm.D., Ph.D. All Rights Reserved.

Recent Comments